Now Reading: US Considers Creating a Strategic Bitcoin Reserve: A Game-Changer for Global Finance

- 01

US Considers Creating a Strategic Bitcoin Reserve: A Game-Changer for Global Finance

US Considers Creating a Strategic Bitcoin Reserve: A Game-Changer for Global Finance

The United States is exploring the creation of a Strategic Bitcoin Reserve as part of its long-term financial strategy. With Bitcoin’s market capitalization surpassing $1 trillion in 2024 and its increasing role in global markets, Bitcoin is being considered by the US as a vital asset to strengthen its national reserves. As of January 2025, Bitcoin’s price fluctuates around $30,000 to $40,000 per coin, signaling its importance as an asset in both institutional portfolios and national financial planning.

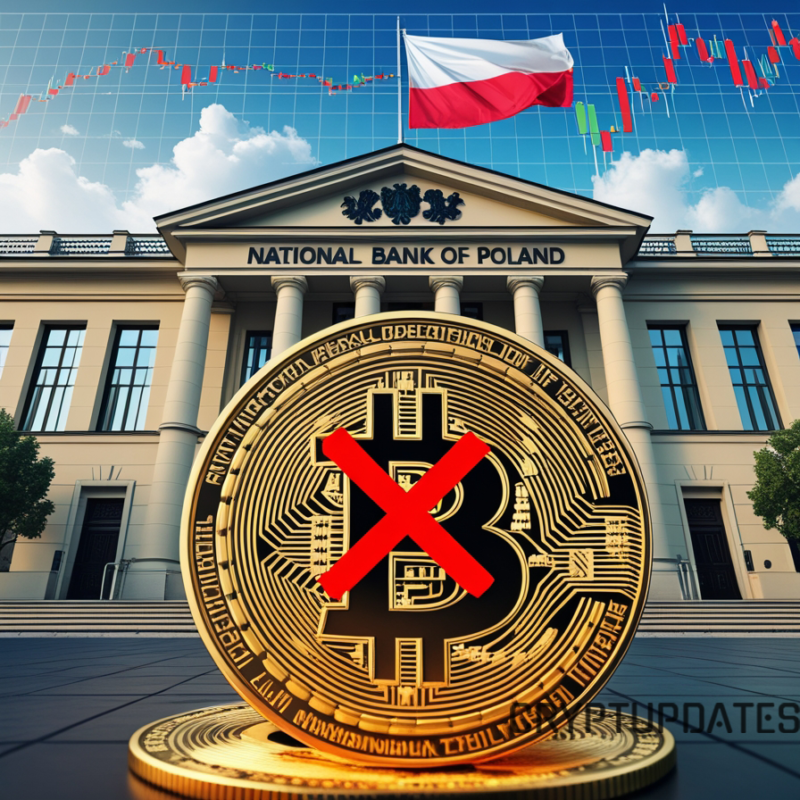

Currently, the US government holds approximately 198,109 BTC (valued at about $21 billion), further supporting the idea of Bitcoin becoming an integral part of its strategic reserves.

Screenshot of the US Government’s Portfolio. Source: Arkham Intelligence

Why the US is Exploring a Strategic Bitcoin Reserve

The Strategic Bitcoin Reserve would involve the US government acquiring additional Bitcoin, adding it to the country’s financial reserves, which currently include assets like gold. This move is driven by Bitcoin’s decentralized nature and its potential to act as a hedge against inflation and financial instability. Bitcoin’s fixed supply of 21 million coins positions it as a deflationary asset, appealing in an era where traditional currencies are at risk of devaluation.

Incorporating Bitcoin into national reserves would also diversify the US’s financial assets, providing an additional safeguard against economic crises. While Bitcoin remains volatile, its growing adoption—backed by major institutional investors such as MicroStrategy and Tesla—proves its potential as a long-term store of value.

Global Effects of a US Bitcoin Reserve

If the US proceeds with this plan, it could initiate a shift toward digital asset reserves worldwide. As nations recognize Bitcoin’s potential as a store of value, other economies, such as China and the European Union, may also consider integrating Bitcoin into their national financial strategies. In 2023, China acquired over 200,000 Bitcoin, a move that further solidified its role as a strategic reserve asset.

The creation of Bitcoin reserves by multiple countries would result in an increased demand for Bitcoin, likely pushing up the price and further establishing Bitcoin as a global benchmark asset. This could lead to Bitcoin becoming a standard part of national reserve portfolios, altering the way countries approach financial stability and currency management.

Bitcoin’s Role in Financial Strategies

Bitcoin’s decentralized nature and its ability to function outside of traditional financial systems make it an attractive reserve asset. Bitcoin’s daily transactions surpass 600,000, reflecting its growing adoption. By 2025, institutional investors such as MicroStrategy and Tesla, alongside national governments, hold a substantial portion of Bitcoin, cementing its position as a major asset class.

As the US moves forward with the concept of a Strategic Bitcoin Reserve, it would highlight the growing importance of digital assets in global finance. Bitcoin’s deflationary properties and increasing use cases—from being a store of value to facilitating international payments—make it a compelling option for any national financial strategy.

Impact on Traditional Financial Systems

Bitcoin’s potential integration into government reserves could challenge the dominance of traditional financial assets and currencies. The US dollar, long the dominant global reserve currency, may face competition from decentralized digital assets. Bitcoin’s growing acceptance by both institutional and governmental players could disrupt traditional finance, leading to a rethinking of global reserve currency systems.

Bitcoin’s market capitalization currently stands at approximately $600 billion, accounting for nearly 45% of the entire cryptocurrency market. With increasing demand driven by government purchases, Bitcoin’s price could surge, further enhancing its credibility and positioning it as a key player in global finance.

What Does This Mean for Crypto Investors?

For cryptocurrency investors, the potential creation of a Strategic Bitcoin Reserve by the US presents an opportunity for significant gains. If the US government begins purchasing large amounts of Bitcoin, demand will rise, potentially boosting its price. However, as Bitcoin moves toward greater institutionalization, increased regulation could follow, which might impact its volatility and decentralized nature.

Investors will need to navigate these changes carefully, staying informed on regulatory developments and adjusting their strategies accordingly.